Small business owners and sole traders in the United Kingdom must be aware of various Small business tax UK.

You may be unsure which UK small business tax applies to you, ranging from income tax to VAT to corporate tax. The standards differ based on the type of business and its performance, so it’s crucial to know what applies to your situation.

We’ve gathered a complete overview of the many Small business taxes in the UK, which ones relate to your business, how to pay them, and when they’re due in this handy guide.

Table of Content

What are the different types of taxes?

You’ll have different tax liabilities depending on your business. They also change according to the type of business, performance, whether you offer products or services, and various other factors.

It might be challenging to determine which category applies to your business, as well as the deadlines for each. To begin, we’ll go through the different types of taxes.

Here’s a brief breakdown of the tax categories:

VAT

VAT (value-added tax) applies to every business with taxable supplies of more than £85,000 per year.

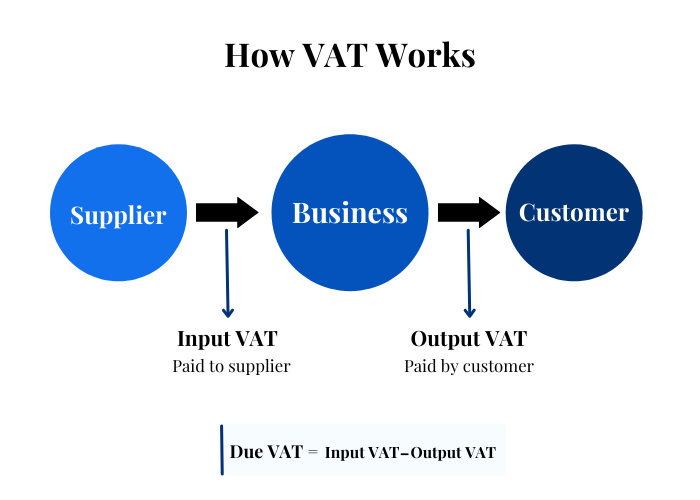

It is an indirect tax charged on the value added to a product or a service. It passes from a supplier to a buyer to a client.

From the buyer’s perspective, VAT paid by a VAT registered buyer to a VAT registered supplier is called input VAT. From the suppliers’ perspective, it is Output VAT.

VAT-registered enterprises must pay VAT and file a VAT tax return to declare how much VAT they’ve charged or collected.

You could recover the difference from HMRC if you paid more VAT than you have collected.

Although the typical VAT rate is 20%, some items or services are subject to lesser rates (or are exempt entirely). Water, sewage services, certain foods and beverages, bank charges, insurance premiums, exports and donated products offered by charity stores are examples of zero-rated commodities.

It is possible to register your business for VAT at any time, but it is advisable to do so as soon as feasible. Registration should be a top priority if your annual taxable supplies reach or are expected to reach £85,000.

Check our guide on : VAT codes

Business rates

If the business occupies any “non-domestic properties”, it’ll pay business rates.

Shops, warehouses, and offices are among them.

Any portion of a domestic property used for non-domestic purposes falls under this category (e.g. a home office). Following are the situations in which you must pay:

- You hire people to work from your house.

- You’ve modified your home so that you can operate a company from it (for example, a hair salon).

- You offer items or products to individuals who come to your house to buy them.

- You run a business on one level and live on the other, making the property commercial and residential.

PAYE

You are responsible for payroll processing, collecting and paying taxes, and any pension contributions if you have employees.

Payroll processing involves:

1. Employee

- Income tax deduction from employee salaries

- Employee NIC and Student loan deductions from employee salaries

- Pension deductions from employee salaries

Check : 5 tips for employees saving income tax

2. Employer

An employer tops up with the:

- Employer NIC contributions

- Employer Pension contributions

Check how much you have to pay as an employer towards NIC contributions on the Employer NIC calculator.

To begin, go to the GOV.UK website and fill out the PAYE form. Depending on your payment plan, you have two deadlines:

You must pay by the 22nd of the following tax month if you wish to pay monthly.

If you want to pay quarterly, the bill is due after the quarter’s conclusion on the 22nd of the month.

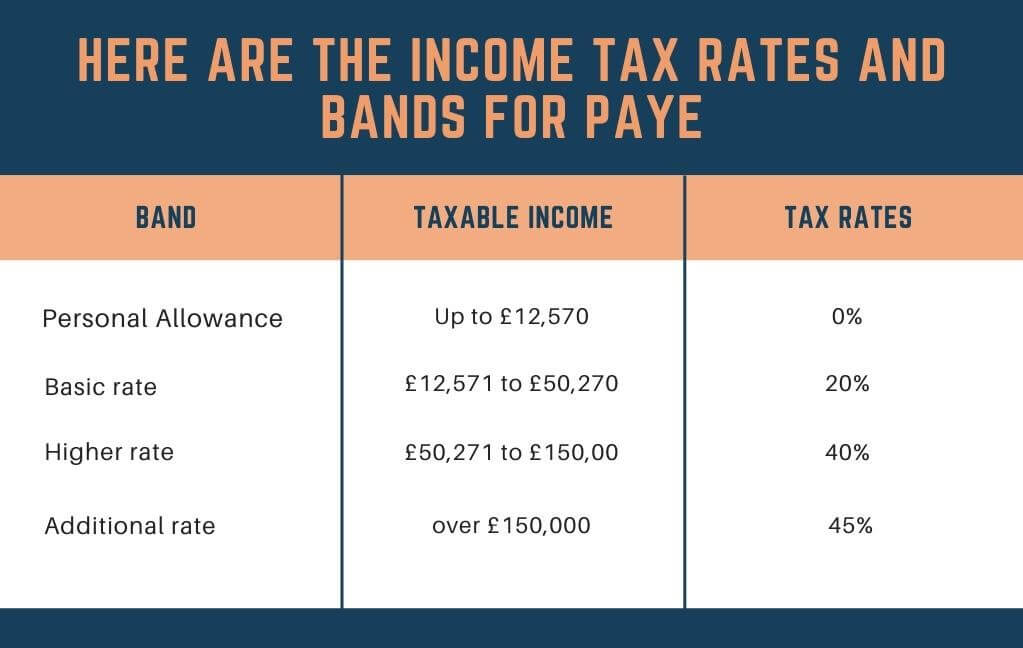

Income tax

Simply put, this is a tax on income you earned as an individual.

As a sole trader, director, or partner, you must pay tax on whatever money you generate.

It includes:

- Earnings from work

- Profits from self-employment

- Government assistance

- Pensions

- Rental revenue over the Rent-a-Room allowance

- Job benefits

- Income from a trust

- Dividend

- Capital gains

- Property income

- Foreign income

Check our guide on : what is income tax and how it works.

There are a few situations where you do not have to pay income tax. In addition, there are several tax breaks available.

You are exempt from paying income tax on the following items:

- As a sole trader, you don’t pay tax if your earnings are £1,000.

- Unless you operate under the Rent-a-Room programme, which allows you to rent up to £7,500 per year tax-free, the first £1,000 you receive from a rental income property is tax-free.

- Income from tax-exempt accounts like Individual Savings Accounts

- Dividends on a business stock that are less than your dividend allowance- £2,000 for the tax year 2021-22

You must file a self-assessment tax return by 31 January (for online tax returns) or 31 October (for paper tax returns).

Check our guide on : how to submit a self-assessment tax return.

Corporation tax

It is a tax which is a one-time payment that each legal entity that meets the following conditions must pay:

- Corporations with a limited liability

- Clubs, co-operatives, and other groups registered in the United Kingdom

- Any foreign firm with a UK branch or company

Profits earned by limited companies are subject to corporation tax. The rate is 19% to 25% for all businesses except ring fence companies.

You will not receive a charge for this, unlike other taxes. However, you must make sure that you calculate how much you owe or seek the help of an accountant.

In terms of company tax, there are two independent deadlines:

- The deadline for submitting is 12 months after your accounting period ends.

- The deadline for payment: This must be submitted nine months and one day after your accounting period ends. If your company’s fiscal year ends on 31 March, for example, this will be required by 1 January.

Usually, in its first year of operation, a limited company files two tax returns- a tax return cannot exceed a year.

For example, if the company was incorporated on 05 December 2020, your accounting reference date would not be 31 December. The year-end will be 31 December 2021.

First tax return- from 05 December 2020 till 04 December 2021

Second tax return- from 05 December 2021 till 31 December 2021.

The yearly tax return cannot cover a period longer than 12 months; two returns must account for the three additional weeks. It is no longer a concern in subsequent years.

To make a payment, go to GOV.UK’s “Pay your Corporation Tax Bill” website and follow the instructions. According to your company income, there’s also information about how much you owe.

National insurance

Finally, to be eligible for a state pension and other government benefits, you must make National Insurance payments (NICs).

You must pay NICs if you are self-employed and generate a profit of £6,515 or more per year or an employee earning £184 or more per week.

If you are self-employed, you may fall into one of the following categories:

- If a sole trader is self-employed, they must pay Class 2 and Class 4 NICs.

- Limited business directors must pay Class 1 NICs, whether self-employed or employed.

NICs are paid through your PAYE payroll as a director, and sole traders must include them in their annual self-assessment. For further information, go to GOV.UK’s National Insurance page.

Final Thoughts

Taxes for small businesses may be difficult, complex, and frustrating. When tax season approaches, even the most organised business owner may feel a sense of dread.

Understanding small company taxes, familiarising yourself with forms and procedures, and organising your records and information will help you move into tax season with less worry.

The tax world is complicated, so we’ve created this blogto assist you. Use it as a reference to determine what type of UK tax you owe and when you must pay it.

Leave a Reply