Whether you are the owner of the business, payroll manager or HR manager, you are probably aware of the challenges of payroll tasks.

Just one error in payroll tasks can set off a series of problems, resulting in unhappy employees and endless difficulties for you.

You cannot afford any mistakes in paying employees, tracking and handling leave requests, ensuring government and regulatory obligations are all met – not to mention the other tasks that also fall under the payroll.

Besides, payroll is very time-consuming if you are using paper files.

Thankfully there is the best way to handle such tasks; you can now use software to manage your entire payroll task.

Table of Content

But picking the right software is also confusing, and to make this simple, we explore some tips.

Check out our guide on why you need payroll software.

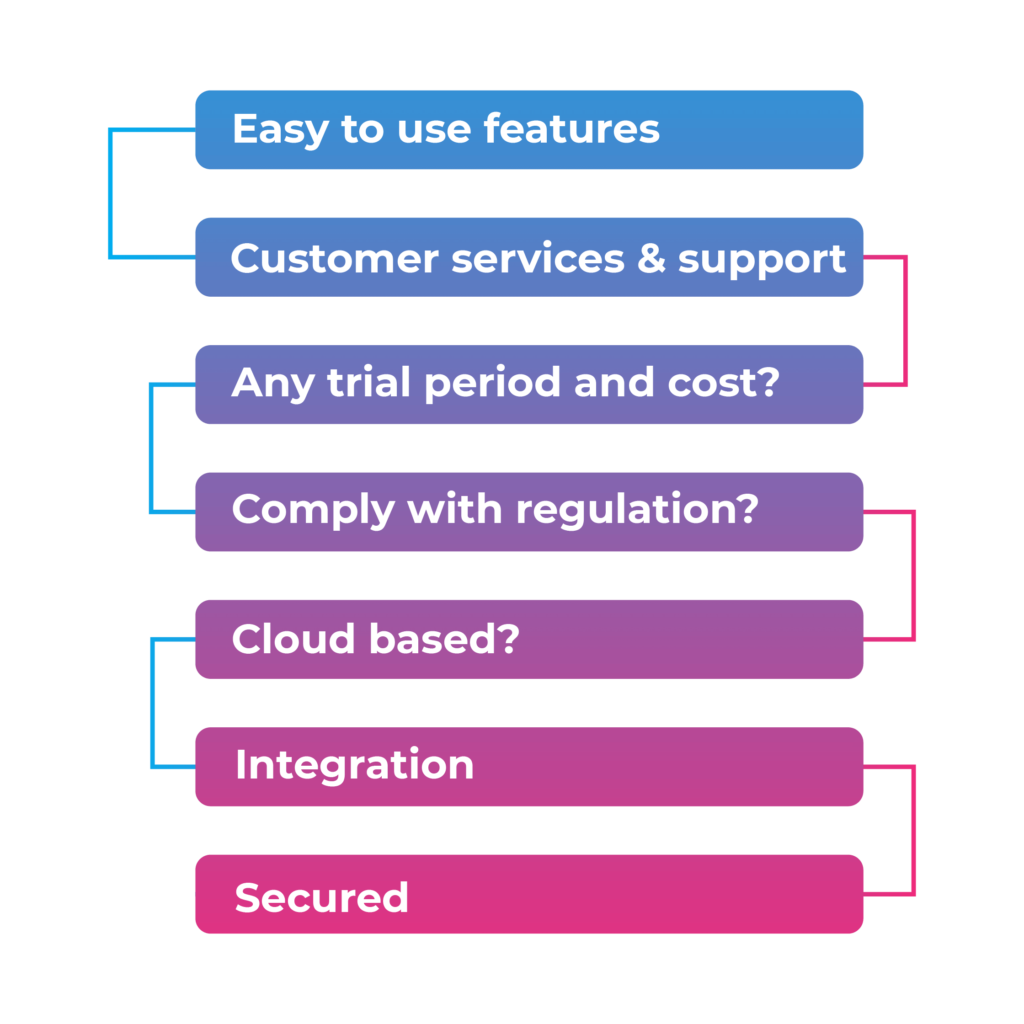

Choose the software that is easy to use

How Technical person are you? It doesn’t matter whether you are an IT pro or a beginner. The learning curve of a payroll system can take so much of your time.

So, ensure that the software you select is relatively easy to use.

You do not need to spend so much time learning how to use payroll software.

Or go for a payroll system you have used in past because using an interface you are already familiar with can speed up your learning.

Customer services and support

Do you think you’ll require a support service for the software you pick?

If yes then, it is worth looking into how you can reach their support team, whether it is over mail, phone or a live chat.

You need to know if their customer support service is helpful and easy to get in contact with.

Even with the most straightforward software available, it is always essential to be sure that you can get in touch with customer support in case something goes wrong.

Is there any trial period?

Before choosing the software, you should also see if you can grab a free trial.

By this, you can avoid the very frustrating mistake of investing in software that you may later find a nuisance or hard to use.

Check whether it’s complying with legislation

Depending on the type of business you run, you also need to look around for software that complies with the current regulations that your company conforms to. For example, in the current COVID-19 pandemic, does it offer a furlough section?

In addition to core functionality, some software services charge for assistance in taxes and other compliance.

So before choosing one, keep in mind the legislation you may need to keep up with and how well each of the individual systems assists you.

If you are running 2021 year-end payroll, check out our guide on running 2021 year-end payroll.

Is it cloud-based?

In a cloud-based system, your data is stored remotely in the cloud rather than on your computer’s hard drive, and with the use of the internet, you can access your payroll service anytime and from anywhere.

Same way you access your Gmail or Hotmail.

In fact, there’s a need to worry about storage, upgrades or backups, as all the data is saved within the system.

Additionally, such a system eliminates the requirement for paper payslips and manual transfers, as all the transactions can be made electronically.

Employees will have a dedicated portal to access and download payslips, P45, P60 and other reports.

In short, companies using cloud payroll systems can pay employees faster as it is done immediately online.

So, select a cloud-based system to do your payroll tasks effectively regardless of your location.

What level of integration is required?

Figure out that what types of reports do you usually make or would like to make?

If you deliver reports across different departments or integrate your software with other systems like the HR department, then you should ensure the service you go with offers the analytical features you require.

Check out our guide on 10 Reasons You Should Integrate Payroll, Bookkeeping & Accountancy.

Is it secured?

Payroll contains confidential information, and it needs to protect both business and employee details.

Ensure you get a system with good reviews and up to date technologies to keep your data safe.

Another point you should check is that the service is compliant with new GDPR requirements, as miss hap in this can put your company in trouble.

Check out the features

If you offer your employees benefits, bonus, and flexible packages, it might be worth looking into the payroll service features.

Main features to look out for usually include:

- Submission of Real Time Information (RTI) returns to the HMRC – essential feature of any payroll software.

- Calculation of employee pay rates, including maternity pay and Statutory Sick Pay

- Tax, NIC and student loan calculations

- Automated batch payments

- Pension administration, including filing

- Employee dashboard- to securely access current and historical payslips, P60, P45 etc

- Compliance with industry-specific legislation such as the Construction Industry Scheme (CIS).

Having an idea of what features like RTI integration, automation, real-time calculation, tax filing etc. you need, will help you select the payroll software that offers the most within the base price.

Cost of the system

How much are you willing to pay for your new payroll system? The cost of a system depends on its services and the need for your business.

Generally, services have a base cost, and then it increases depending on the features you take, so be sure what you really want beforehand to get the best deal.

If the result is that the overall cost is too high, then consider outsourcing your payroll.

Check out our blog on how much does outsourced payroll costs?

Final thought

The list mentioned above is not exclusive but a stepping stone to point you in the direction before selecting payroll software.

When you choose a perfect technology to suit your business, doing your payroll tasks will no longer be stressful.

Leave a Reply