Self-filing taxes is a time-consuming task, and mistakes on HMRC tax returns can be frustrating. You may complete everything on time or even ahead of schedule to discover that something on the return was incorrect.

Is it possible to make amendments to a tax return after it has been filed? Don’t worry; if you make a mistake, HMRC will give you a chance to correct it. Whether you think you’ve declared too little or too much, we’ll show you how to fix your mistake.

We will discuss why you need to amend a previously filed tax return. We’ll also make sure you understand how to file for an updated refund and pay any additional tax due.

Table of Content

What exactly is a tax return, and how do I file one?

Let’s speak about a self-assessment tax return and why you might need to file one before getting into the details (like deadlines, figures, and penalties).

Wages, savings, and pensions all have taxes deducted automatically.

However, if you’re self-employed or have an income source that isn’t covered by the PAYE plan (where your employer deducts taxes and NI contributions from your wages), you’ll have to record and pay your income taxes to HMRC. You can do this on a Self-Assessment tax return.

If you’re in the following categories, you must submit a UK Self-Assessment tax return:

● self-employed as a sole trader

● or as a partner in a business partnership

● Employment income exceeding £150,000 (£100,000 for tax year 2022/23 and before)

If you have income other than ordinary earnings and pensions, you may still need to file a return, such as:

● Rental income

● Tips or commissions as a source of income

● Expenses from abroad

● Dividends, interest, and savings

● Grants and support payments for COVID-19

You must apply for Self Assessment to commence trading if you fall into any of these categories before the end of the tax year. Once you’ve enrolled, you’ll need to fill out a return and submit it to HMRC online, via mail, or through third-party tax software.

Check our guide on: How to calculate your income tax? Step-by-step guide for income tax calculation.

Why should you need to amend your tax return?

You’re done with taxes for the year once you’ve submitted your hmrc tax return. Unless you discover an error and need to correct it or HMRC discovers an inaccuracy in the information you supplied.

Depending on the inaccuracy made on a tax return, HRMC may impose penalties. But don’t be alarmed. They have given an alternative for modifying returns that allows you to remove errors as soon as you notice them.

Check our guide on: Self Assessment penalties: How to avoid and what to do if you file late.

Both the taxpayer filing and HMRC can make corrections to a tax return. However, either party may alter a return because of faulty figures or inaccuracies. The types of alterations that each is in charge of are listed below.

HMRC corrections

HMRC will correct any apparent inaccuracies in return. In addition, they can make changes to a taxpayer’s return to correct or eliminate problems. These are mainly arithmetic errors or minor technicalities.

Before proceeding, HMRC will advise you of any suggested changes to your original return and receive your permission. After that, you have a limited amount of time to accept or reject the proposition. If you leave it and HMRC disagrees, they have the right to launch an investigation.

GOV.UK has more information on when HMRC sends an amended tax return.

Taxpayer amendments

A taxpayer also has the option of amending tax return a previously filed return.

You don’t have to wait for HMRC to notice the error and suffer penalties for submitting incorrectly. Instead, you can take the initiative and make the necessary changes.

If you find yourself in this situation, you may want to make the following changes:

● You want to update your personal information with HMRC.

● Consider whether you paid too much or too little.

● recorded incorrect data or information on the tax return

Filing an amendment will let you make up for underpayment before it results in a penalty. It also allows you to reclaim money if you overpaid your taxes in a particular year.

When can you amend a return?

You (or HMRC) have a fixed amount of time to update your return. You may still be allowed to make changes if you don’t address any issues within this time frame. However, if you want to discuss it further, you’ll have to write to HMRC directly.

When the taxpayer can amend a return

After filing your return, you must wait at least 72 hours before making any adjustments. After that time has passed, you have one year to file an amendment after the tax return is due.

The following are the filing deadlines for the most recent tax years.

● 31 January 2022 (2021-2022 tax year)

● 31 January 2023 (2022-2023 tax year)

● 31 January 2024 (2023-2024 tax year)

If you miss these deadlines or need to make changes for a future tax year, you must write to HMRC.

When HMRC can amend a return

For up to nine months after a tax return is submitted, HMRC can change it. They will notify you of the proposed changes by the agency, and you will have the option to accept or reject them.

If you disagree with what they propose, you have 30 days from the day HMRC sent the notification to dispute the proposed modifications.

GOV.UK has more information on how HMRC can adjust your tax return.

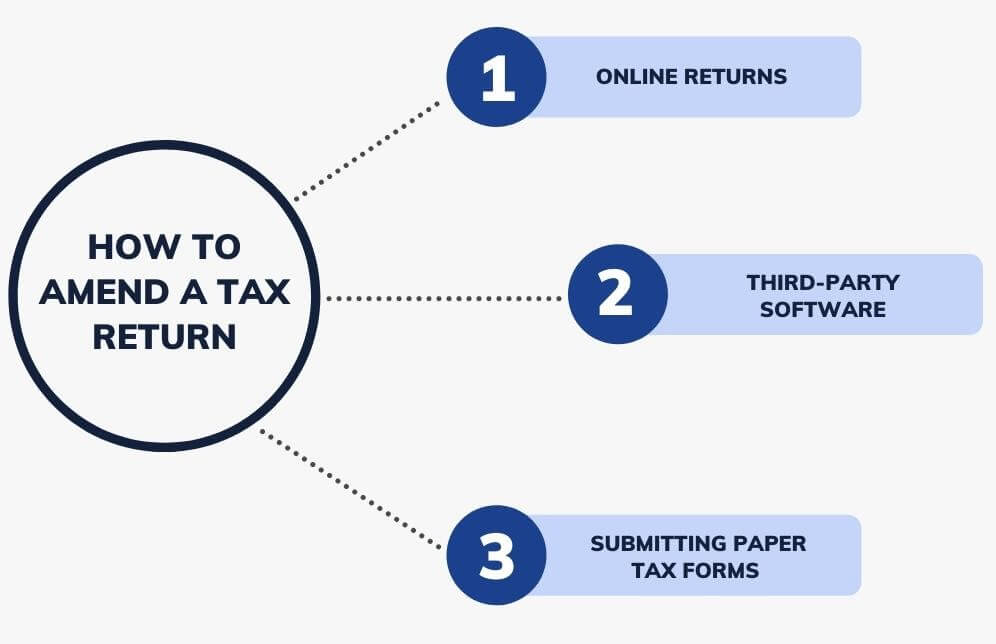

How to amend a tax return

How you amend your return is determined by how you initially submitted it.

You have three options for filing: online returns on the HMRC portal, third-party software, or submitting paper tax forms.

You must file a tax return using commercial software or paper tax forms if you:

● Are you a partner in a business?

● Are you preparing a trust or estate plan?

● Invest in a trust to generate income.

● Lived abroad

● Are an underwriter for Lloyd’s

● Are a religious minister

● Want to record earnings from the sale of multiple assets (‘chargeable gains’)

● Below are the processes for completing each of your tax return options.

Make a return online

If you’re self-employed or need to file a return due to income earned outside of PAYE, you can do so online. Once you’ve enrolled, go to GOV.UK and log in to your online tax account to complete the return by the deadline.

Check our guide on: How to Submit your first Self-Assessment Tax Return.

Return on paper

You can choose to file your returns by mail. All you have to do is go to GOV.UK, download the forms, print them off, and submit them before the deadline.

Third-party software

Third-party software might assist you in completing your tax return. Some systems can even track your records throughout the year, so you know exactly how much money you’ll have to pay at the end of the year.

In addition, this software frequently provides you with the opportunity to speak with an accountant who may check your return for correctness before filing. HMRC has supplied a list of recognised commercial software suppliers on their website for your convenience.

How to claim a refund

You can claim your money differently depending on how you submitted your amendment.

You can make changes online. Then, after you’ve submitted your return, you’ll be able to view the adjustments to your tax bill right away.

Even if your tax bill shows that you overpaid, HMRC will not immediately offer a refund. Instead, you’ll have to ask for it. So, first, go to your HMRC online account to request a refund. Then, select “request payment” from the left-hand menu. You can also request repayment by calling.

Changing the paper HMRC will send you an amended tax bill four weeks after submitting an updated paper return. Your refund would be credited directly into your bank account if you provided your bank account information on your tax return. You might get it in the mail if you don’t want to wait.

Wrapping up

Revising your tax return can be a simple process, but you will be limited in the amount of time you have to do it, and you must be sure that what you are amending is correct. You can also consult a self-assessment tax return accountant for any assistance.

It doesn’t have to be a stressful situation, though. As long as you follow the regulations, HMRC provides a straightforward method to assist you in sorting and updating information as fast as possible.

Leave a Reply