Table of Content

What is Making Tax Digital (MTD)?

Making Tax Digital (MTD) is a critical component of HMRC’s goal to become one of the world’s most technologically advanced tax administrations.

MTD seeks to make it easier for individuals and companies to file taxes digitally and stay organised.

HMRC is sure that people will find it simpler to comprehend how much tax is owing within their digital tax account, similar to how they would with online banking.

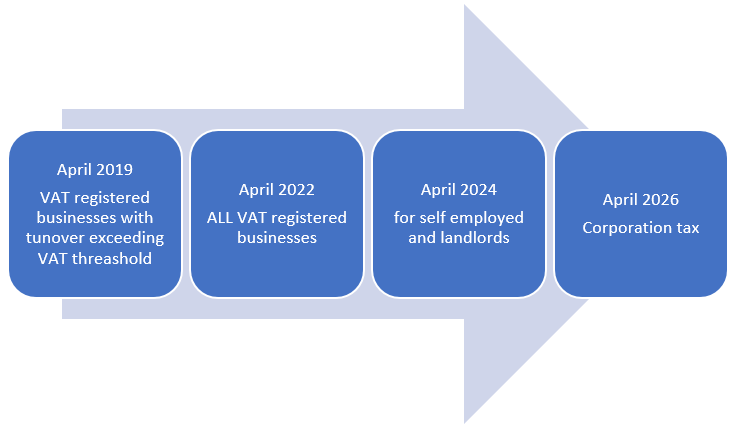

If your company is VAT registered, you must now submit your VAT return electronically through MTD compatible software. If your company is already VAT-registered or will cross the registration threshold, you must begin taking action right now to prevent penalties.

All VAT-registered firms will be required to retain digital VAT records and submit returns using MTD-compatible software.

Unincorporated enterprises and landlords with a total annual revenue above £10,000 will be subject to MTD for Income Tax Self Assessment (ITSA) beginning in April 2024. Before its launch, most enterprises will have two years to plan and test the service on their own time.

Advantages of MTD

The new Making Tax Digital (MTD) programme intends to modernise the way taxpayers submit tax records as part of the government’s drive to digitise vital commercial services.

- Many of the old paper-based procedures will be eliminated due to the shift to digital integration, decreasing mistakes and allowing firms and their agents to dedicate more time to operating their enterprises. When you replace paper-based bookkeeping with digital tax accounts, you can double-check that HMRC’s information on you is correct. Moreover, your business’s financial records are updated in real-time.

- Software not only aids in the efficient operation of a business, but it also helps to eliminate unnecessary errors in business records that can arise when manual computations or information transposition by hand.

- Reduced errors. Data will be transmitted digitally, minimising human error in data entry significantly. Businesses can limit the risk of mistakes caused by missing or wrongly recorded invoices by maintaining digital records.

Keeping business documents online makes it easy for a company to communicate them with its agent, saving time and money while allowing agents to focus on higher-value activities.

- Taxpayers can look at up-to-date tax information instantaneously thanks to Making Tax Digital’s new digital reporting.

- Businesses and agents are increasingly seeing the advantages of digitisation. Going digital simplifies the process of handling a company’s finances. Millions of people are now banking, paying bills, and engaging online; taking company records and taxes digital is the next step, providing companies greater control and the capacity to plan with their finances.

Some firms will have to learn to adapt how they keep track of their finances, but they will benefit from doing so digitally. They can also hire an accountant who can guide them properly.

Facts to Know About MTD

- VAT

VAT-registered firms can file their returns online using bookkeeping software or manually enter the numbers into the Government Gateway.

Affected firms can no longer access the Government Gateway website under MTD for VAT. Instead, they’ll have to use MTD-compliant software to file their VAT returns. They’ll also have to keep track of everything online.

For firms affected by MTD for VAT, this implies handwritten records will be obsolete.

The dates for filing VAT returns and paying VAT have remained unchanged.

Businesses must employ software to retain digital records of their operations. Dedicated record-keeping software, as well as a mix of software programmes or spreadsheets, can be used.

In the case of spreadsheets, this implies that the programme must electronically extract the required data from the spreadsheet and submit it to HMRC.

VAT registered businesses with the turnover exceeding the VAT registration threshold are submitting the VAT returns under MTD since 1 April 2019.

- Software

MTD-compatible software can connect to HMRC systems and transmit information directly.

HMRC does not sell software, but it does supply the Application Programming Interfaces (APIs) that commercial software developers use to create various apps that allow businesses to retain their records digitally and interface with HMRC systems. An API enables communication among two or more software programmes.

HMRC collaborates closely with software developers to help them build new and more complex products.

Conclusion

MTD makes it simpler to get things right; digital record keeping reduces the chance of unpleasant and costly HMRC compliance interventions, and it helps firms better manage their cash flow. Businesses of all sizes can benefit from utilising software to maintain digital records. The increased accuracy of digital records, with the assistance integrated into many software programmes and the fact that information is delivered directly to HMRC from digital records, minimises the tax wasted due to these preventable errors.

Leave a Reply