Construction budget management acts as a basic financial blueprint, meticulously describing projected costs and expenses for a construction project. It is a vital guide to managing financial resources throughout the project’s lifespan, from its inception to completion.

Construction budget management is more than just a financial plan; it’s an instrumental tool for ensuring project success.

In this blog, we will check out how to effectively manage the construction budget for your next projects.

Table of Content

Key takeaways

- Construction budget management ensures projects stay within budget by managing resources from start to finish.

- Key components include cost estimation, control, financial reporting, and risk management.

- Create a budget by defining the project scope, estimating costs, including contingencies, planning financing, and continuous monitoring.

What is construction budgeting?

Construction budgeting involves carefully organising and allocating financial resources to pay for the various costs related to a construction project. This procedure is essential since it aids in the full management of both minor and major expenses, guaranteeing the project completion within the allocated budget.

Effective construction budgeting includes everything from initial costs, including planning and permits, to hard costs, such as materials and labour, and soft costs, such as legal costs and insurance.

By foreseeing future risks and financial requirements, construction budgeting helps contractors and project managers make well-informed decisions, reduce financial waste, and optimise value over the project’s duration.

Core components of construction financial management

1. Budgeting and estimating

First, you must establish the entire project’s expenses before it starts. Budgeting involves estimating materials, labour, equipment, and additional costs. By estimating, you can ensure that you set aside adequate cash for each stage of the project and prevent overspending.

2. Cost control measures

Cost management involves monitoring spending during the construction process to guarantee it doesn’t go over budget. It entails monitoring every expenditure and making adjustments as necessary to maintain an ideal budget.

3. Financial reporting

Accurate and timely financial reporting offers information about the project’s financial state. This involves creating P&L statements, balance sheets, and cash flow statements to demonstrate financial transparency to stakeholders and aid in decision-making.

4. Risk management

Recognising, evaluating, and reducing financial risks is essential. This entails evaluating any overruns, delays, and unanticipated costs to minimise their effects on the project’s budget and schedule.

How to create a construction budget

Now that you know what a construction budget is, let’s take you through the steps to create one:

1. Define the project scope

Before starting the budgeting procedure, you must lay a solid foundation to back up the process. The project’s scope offers this foundation.

This project scope often acts as a roadmap for the development process. It determines what the project will achieve, how it will get done, and the finances and limits involved. A simple and feasible scope can prevent disputes, unnecessary waste, and scope creep.

At this point, you can create a formal document – like a project scope statement– that defines the project scope in detail.

2. Estimate costs

After deciding the project’s scope, it is important to gather comprehensive projections for all potential expenses.

This includes understanding:

- The type and standard of construction materials to be used

- Labour expenses

- Equipment and machinery needs

- Safety rules and regulations to be followed

Planning for costs helps you budget accurately, anticipate potential issues, and adjust your plans as needed. Use past data, vendor quotes, and industry standards to guide your cost estimates.

3. Include contingencies

It’s crucial to budget for unforeseen expenses and include a contingency amount. Depending on the project’s complexity and risk, this typically represents 5–10% of the total expected expenses.

4. Plan for financing

Determine how a project will be funded. Will it be paid out of pocket, or will loans be needed for financing? To guarantee a thorough financial picture, factor in interest and financing costs while creating your budget.

5. Start managing the project

Engage with key stakeholders—architects, financial experts, contractors, and engineers—throughout the estimation process. This collaboration has two purposes: it helps identify potential problems before the project begins and guarantees everyone agrees with the budgeted goals.

Also, remember to constantly monitor and track actual costs against the budget. To lower the possibility of cost overruns, you must frequently evaluate the status and make adjustments as necessary.

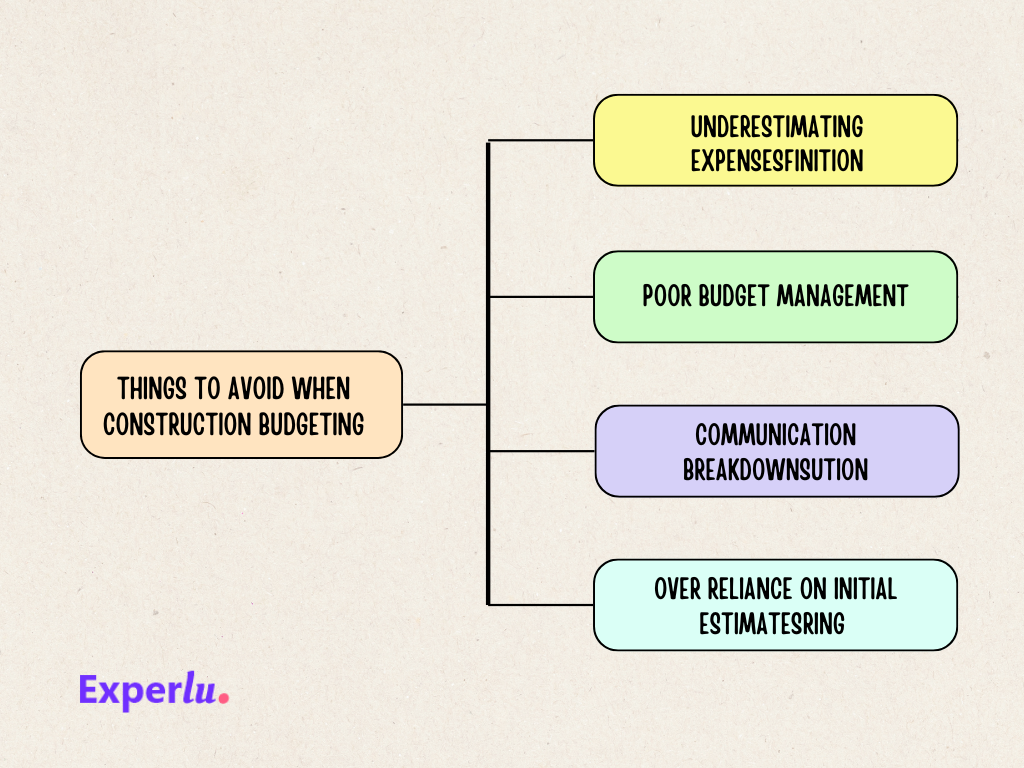

Things to avoid when construction budgeting

Avoiding specific risks is important when handling construction budgets to ensure financial security and project success. Here are five important factors to avoid:

1. Underestimating expenses

A prevalent error in construction planning is underestimating expenses related to labour, materials, equipment, and unforeseen circumstances. This can lead to substantial financial shortfalls as the construction work progresses.

2. Poor budget management

Budget management is a continuous procedure. Sufficient monitoring is necessary to ensure the projected expenses align with the project schedule. This monitoring will reduce the risk of unanticipated falls in projected profits.

Not constantly evaluating and budget tracking can lead to overspending without realising it until it’s too late. Regular reviews and modifications based on actual expenditure and project progress are necessary for effective budget management.

3. Communication breakdowns

Nearly two-thirds of construction projects experience delays due to inadequate communication. This risk can be reduced by ensuring your team and subcontractors are familiar with the project’s communication channels.

Maintaining an efficient information flow is essential to preventing unforeseen expenses and ensuring the project moves forward as planned.

By tackling these areas—comprehensive planning, accurate cost estimation, diligent budget management, and strong communication—a construction project can substantially boost its chances of success and stay on plan and within budget.

4. Over-reliance on initial estimates

Relying excessively on initial estimates without considering market fluctuations or updates based on particular projects can lead to unrealistic budgeting. As new information becomes available and project specifics are finalised, it is essential to update the budget.

Final thoughts

Construction budgeting is an essential component of any construction project. To gain insights into construction budgets, consult with a construction accountant. Their expertise will help you effectively create and manage your project’s financial aspects.

It’s not just about developing a budget; it’s about following it, examining it regularly, and modifying it when necessary. After all, an extensive construction budget is dynamic and must be an active financial management tool throughout your project!