Business owners find difficulty handling finances and cash flow from starting days to success years. Accounting is not just crunching numbers but controls a range of services like recording transactions, making financial reports, tax planning and preparation, cash flow management, expense management, business financial advisory, and others.

One can reach out to accountants for help and enjoy additional services at a price they offer. But, how much do accountants charge? Here is a handy guide for understanding an accountant’s fees and services in the UK.

Table of Content

Who are accountants?

An Accountant possesses knowledge, experience, and expertise to record, summarize, present and interpret businesses’ financial information, helps it grow, and assists in the better decision making.

Accountants in the UK usually have a bachelor’s degree and a professional degree, with an practicing certificate to provide accounting services. They have expertise in different accounting fields and help businesses deal with finance function within a company.

But, a question that haunts small business owners or individuals is how much does a UK accountant cost?

What is the cost of hiring accountants?

We have often seen how the cost of service affects the quality of the service. Accountants charge fees on individuals looking into different factors. However, as a client, you must compare the costs and quality of services between two or more firms.

Some accountants may not disclose their price and leave the client in a dilemma about whether to hire or not. That is because the cost of accountants depends on the size and type of business, annual turnover, number of employees working, types of services required, and location, among others.

What is the typical fee structure of an accountant?

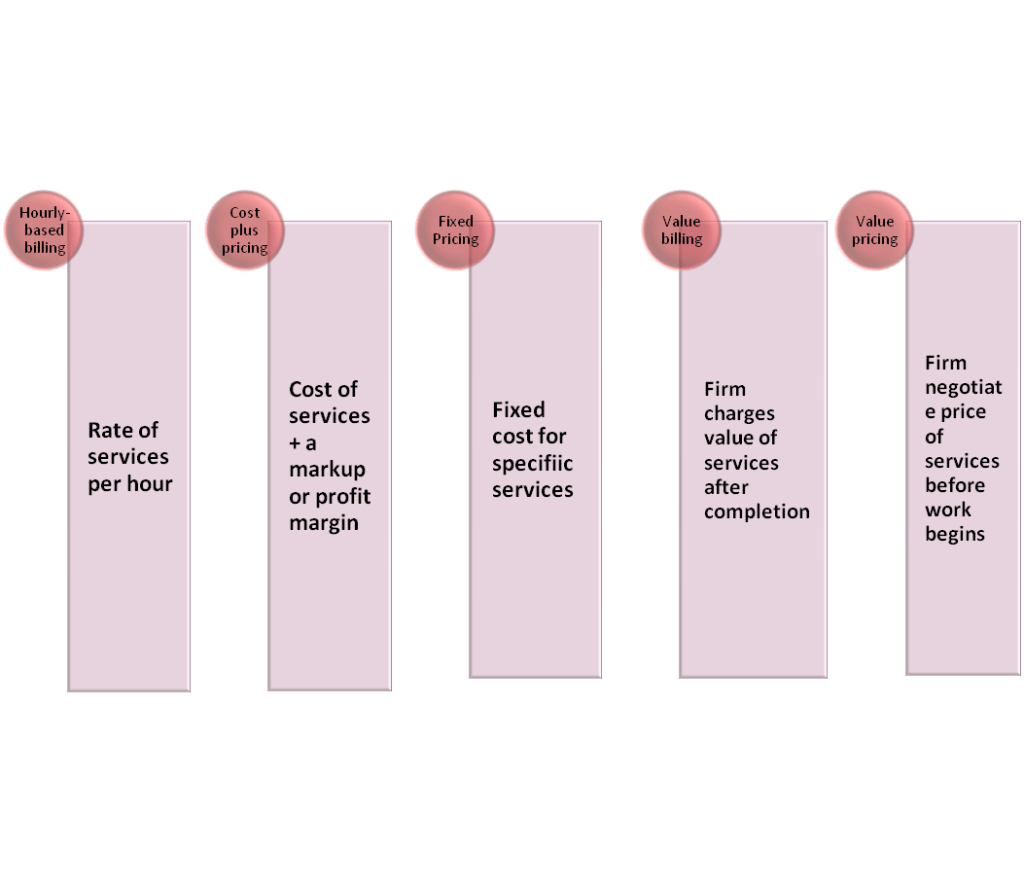

Hourly rate

Most accountants offer hourly rates to hirers, and the price depends on their experience, certification, and training.

Some businesses have fewer tasks, and hiring an in-house accountant can be costly. They can contact a accountants for freelancers or a self-employed accountant at an hourly rate.

Generally, the basic services come at an hourly rate of £35 to £55, and expert services between £125 to £250 per hour.

Retainers

The typical fee structure is a monthly retainer when outsourcing the accounting task to a firm. As the name goes, an owner needs to pay for the accounting services every month. However, you can discuss with the provider if the payments will be on a monthly, quarterly, or yearly rate basis.

Project rates

Some accountants are not related to retainers and hybrid business models. Therefore, they offer you a flat rate for everyday accounting tasks. The price chart is customisable according to the size and type of business and the project’s complexity.

Fixed rates

If you are looking for an accountant who regularly performs your financial activities and offers a special price against it, you can proceed with fixed-rate paying. You pay the same amount for the same services every month.

Value pricing

It is pretty similar to fixed rates. Under the value pricing methods, accountants negotiate the cost of services before starting their work. Clients receive a package of services from accountants that ensures all the necessary services are covered.

There are three tiers of value pricing: Good, Better, and Best while considering the accounting costs.

Value billing

It is similar to value pricing, except the dependence factor is not services but the length of time to complete each accounting task. Here, accountants may ask for a percentage of the total worth of service offered.

Cost-plus pricing

If your accounting service includes technology, the accountant or accounting firms may charge you a fixed rate added to markup or profit margin. Accountants need to use technology and pay its costs on behalf of the client.

Fig: Typical fee structure of an accountant

Why do the accounting charges fluctuate?

Accountants may charge you per hour or a fixed rate. But why does this rate go higher at times? It is not possible to quote an appropriate fee for accountants by simply knowing you, your business, and what services you need.

While hiring an accountant, you will fill out a 64-8 form, which gives the accountant authority to work with HMRC on your behalf. Therefore, accountants can deal with HMRC on any issue with your tax returns.

That means the more significant the tax complexity, the more accounting cost will be. When an individual has more than one source of income, their tax structure can become complicated and needs additional effort to file tax returns by the accountants correctly. Generally, it may cost you something between £100 – £400 yearly.

According to the accounting firm or accountant, accountants can offer the essential services at £20 per hour or around £35, or a fixed price. They can charge you about £150 per hour for complex tax planning.

| Estimated costs of an accountant | |

| Services | Typical fees* |

| Maintaining business accounts | £150 – £600, depending on the annual turnover |

| Payroll services (including PAYE) | Between £5 – £15 per month per payslip |

| Director’s tax return | £300 |

| VAT returns | £100 – £300 |

| Self-assessment and tax returns | £150 – £450 |

| Basic accounting services | £35 – £55 per hour |

| Business and Tax planning | £125 – £150 per hour |

| * All prices exclude VAT. |

What will you be paying an accountant for?

Companies

Young entrepreneurs look for expert advice while starting a business. An accountant can help them with:

● Registers your business with the Company’s House and HMRC

● What business structure fits you?

● Prepare business plan

● Compliance services like bookkeeping, payroll, VAT returns, preparing and filing accounts with the Companies House, and Preparing and submitting tax return CT600 to HMRC

● Submitting annual confirmation statement to the Companies House

● Guides you on using accounting software

● Advising and assisting you in opening a business account

● Checks whether your accounting system complies with the government rules and regulations

● Helps with daily financial activities

● Teaches the importance of separating business finance from personal funds

● Provides tax investigation services, and tax advisory

● Prevents penalties from HMRC

● Identifies areas of business growth

● Assists in audit inspection

● Builds financial forecasts

● Prepare management accounts

Self-employed

● Track financial transactions

● Minimise tax liability

● Bookkeeping

● Business advice

● Tax planning

● Business banking

● Invoicing

● Salary planning

● Payroll

● VAT returns

● Self-assessment

There are several other services an accounting firm can provide you. Therefore, before hiring one, you must study the benefits and costs of accountants in the UK.

Wrap up

Hiring an accountant can be a little costly for startups or small businesses. But, hiring one is worth the cost, as they save your money and time. When the company starts growing, financial complexities increase, and owners may find it challenging to handle them besides performing business operations. The charges of accountants can vary, so while interviewing different candidates, ask about their costs and the process of billing. If you clear things with the accountant initially, it will save time and energy in the future.

Leave a Reply